Maximize Your Deductions with AI Technology in 2025

Discover how AI technology can help you optimize your tax deductions in 2025. Learn tips and tools to maximize your savings efficiently.

As tax season approaches, many individuals and businesses seek ways to optimize their deductions to minimize their tax liabilities. With the advent of advanced AI technology, maximizing deductions has become more efficient and effective. This article explores how AI tools and strategies can enhance your deduction capabilities, providing you with insights to make informed financial decisions for 2025 and beyond.

As we enter 2025, leveraging AI technology can significantly enhance your ability to maximize tax deductions. By utilizing innovative tools, you can streamline data analysis, identify potential deductions, and ensure nothing is overlooked. For those looking to refine their branding in this digital landscape, view 3D logo variations for a more professional representation.

Table of Contents

Understanding Deductions

Deductions are expenses that taxpayers can subtract from their taxable income, significantly impacting the amount of tax owed. In the U.S., common deductions include:

- Mortgage interest

- State and local taxes

- Medical expenses

- Charitable contributions

Understanding which deductions you qualify for is essential to reducing your taxable income. However, keeping track of receipts, expenses, and relevant documentation can be overwhelming. This is where AI technology comes into play.

The Role of AI in Tax Deduction Maximization

1. Automated Data Collection

AI tools can automate the collection and organization of financial data, making it easier for taxpayers to maintain accurate records. For instance:

- Data extraction from receipts and invoices

- Expense tracking through smart categorization

- Integration with bank accounts for real-time transaction monitoring

These capabilities not only save time but also reduce the risk of human error in data entry.

2. Intelligent Expense Categorization

AI-driven systems can categorize expenses intelligently, ensuring that nothing is overlooked. Utilizing machine learning algorithms, these systems learn from your past transactions and provide suggestions based on patterns, which can include:

- Identifying recurring expenses that qualify for deductions

- Flagging potential deductions based on user-defined criteria

3. Predictive Analytics

Using AI for predictive analytics helps taxpayers to estimate future deductions and plan accordingly. By analyzing financial trends and past tax returns, AI can provide insights into:

| Year | Estimated Deductions | Actual Deductions |

|---|---|---|

| 2021 | $12,000 | $11,500 |

| 2022 | $14,000 | $13,500 |

| 2023 | $16,000 | $15,200 |

This tool can help you set realistic goals for your deductions each year.

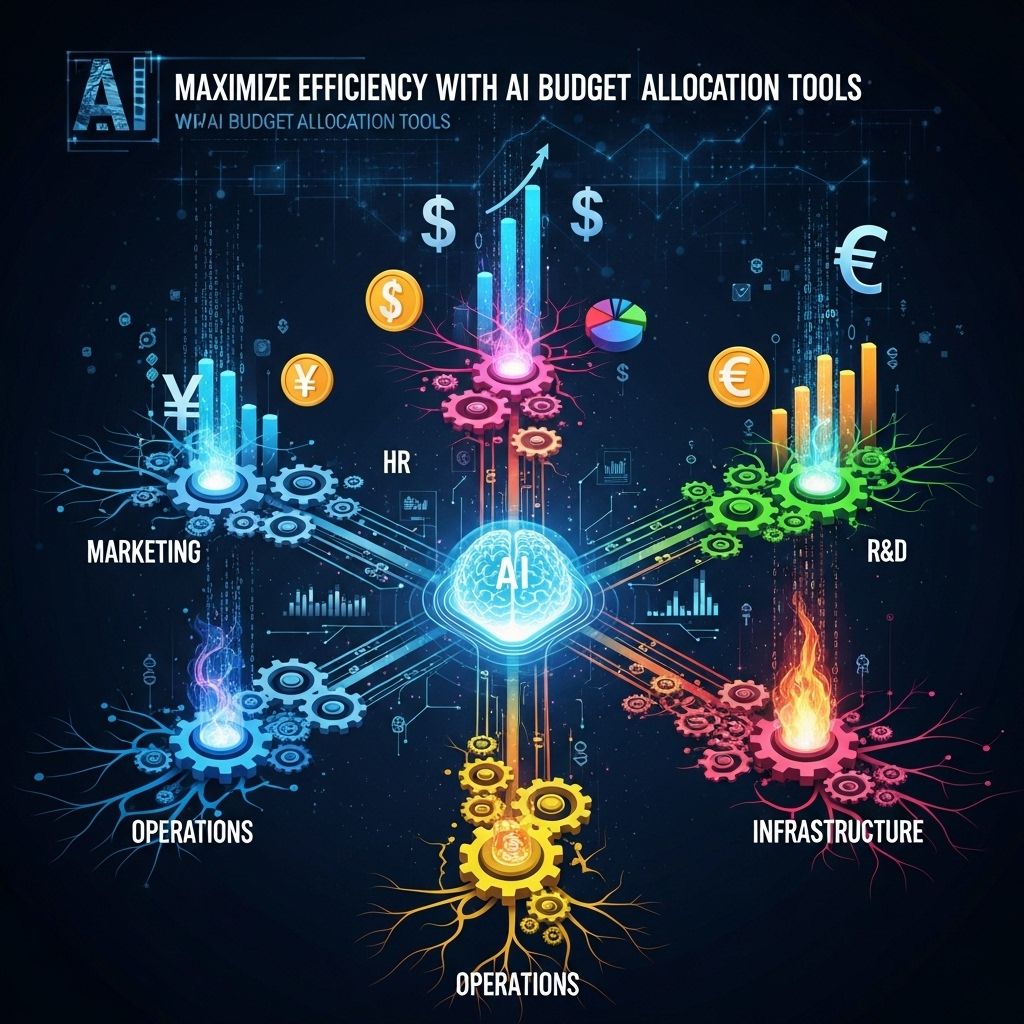

Exploring AI Tools for Tax Efficiency

1. Tax Software Solutions

Many tax preparation software solutions now integrate AI technology, making them more robust in helping users maximize their deductions. Some popular options include:

- TurboTax

- H&R Block

- TaxSlayer

These platforms typically offer guided workflows that leverage AI to identify potential deductions based on user inputs.

2. Expense Tracking Applications

Apps like Expensify and Shoeboxed utilize AI to help users capture receipts, categorize expenses, and ensure they are tax compliant. Key features include:

- Receipt scanning and automatic entry

- Integration with accounting software

- Cloud storage for document retrieval

3. Personal Finance Management Tools

Tools such as Mint and Personal Capital can help users manage their finances holistically, allowing them to spot tax-deductible opportunities across various financial activities.

Best Practices for Maximizing Deductions with AI

1. Stay Organized

Maintaining well-organized financial records is crucial. Use AI tools to regularly input and categorize expenses, rather than waiting until tax season.

2. Regularly Update Software

Ensure your AI tools are up to date to benefit from the latest features and compliance updates. Software developers regularly enhance their capabilities to adapt to tax law changes.

3. Consult with Professionals

While AI can provide valuable insights, consulting with a tax professional can help clarify complex situations and ensure you are taking advantage of all available deductions.

Future Trends in AI and Tax Deductions

As we move deeper into the 2020s, the integration of AI technology with tax deductions is expected to grow exponentially. Future trends may include:

- Enhanced natural language processing for better user interaction

- Increased use of blockchain for secure transactions and record-keeping

- AI-driven tax advisory services that provide real-time recommendations

Conclusion

Maximizing deductions is an essential part of navigating the complexities of personal and business taxes. By leveraging AI technology, individuals can streamline their financial data management and enhance their ability to capture eligible deductions. As technology continues to evolve, it is crucial to stay informed and adapt to new tools that can further improve your financial efficiency.

FAQ

What are the benefits of using AI technology for maximizing tax deductions in 2025?

AI technology can analyze vast amounts of data quickly, identifying potential deductions and credits that might be missed manually. It streamlines the tax preparation process, ensuring accuracy and maximizing savings.

How can I integrate AI tools into my tax preparation routine for 2025?

You can integrate AI tools by using software that incorporates machine learning algorithms to analyze your financial data, categorize expenses, and suggest potential deductions tailored to your situation.

What types of deductions can AI technology help identify for my business in 2025?

AI technology can help identify a range of deductions, including operational expenses, home office deductions, travel costs, and depreciation on assets, ensuring you capitalize on every eligible deduction.

Is AI technology reliable for tax preparation and deductions?

Yes, AI technology is designed to enhance accuracy and efficiency in tax preparation. However, it is essential to review the recommendations and ensure compliance with current tax laws.

Will using AI technology for tax deductions save me time?

Absolutely! AI can automate many tedious tasks involved in tax preparation, allowing you to focus on strategic financial planning while ensuring you don’t miss out on any deductions.

Are there any risks associated with using AI for tax deductions?

While AI technology can greatly enhance efficiency, potential risks include reliance on incorrect data input and the need for human oversight to ensure that all deductions comply with tax regulations.