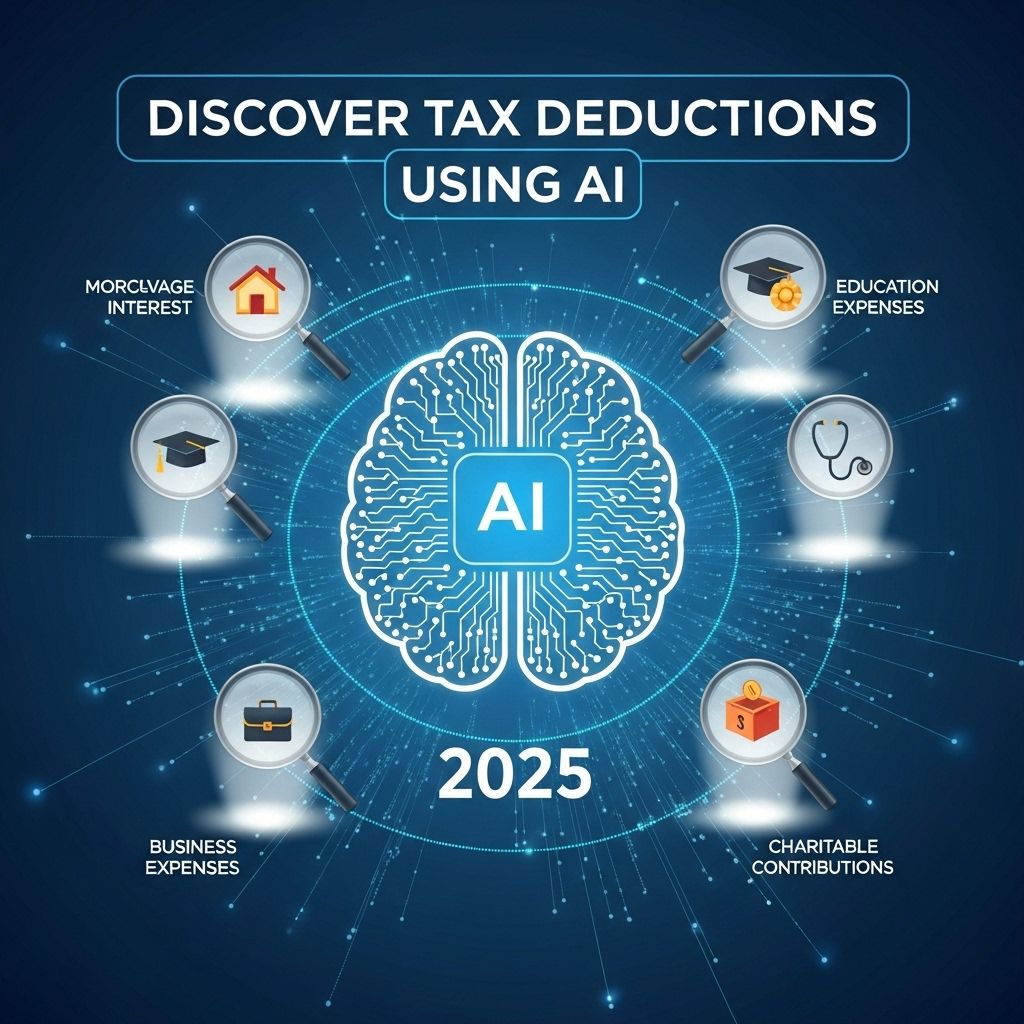

Unlocking AI for Tax Deductions in 2025

Explore how AI can help you discover tax deductions in 2025, maximizing your savings and simplifying the tax process.

As we venture further into the world of advanced technologies, artificial intelligence (AI) is becoming a cornerstone for various industries, including finance and taxation. In 2025, AI is set to revolutionize how taxpayers identify, understand, and maximize their tax deductions. This article delves into the innovative ways AI is being utilized to enhance the tax deduction processes, its implications for individuals and businesses, and actionable strategies for leveraging these technologies.

As we move into 2025, the integration of AI in tax preparation presents unprecedented opportunities for maximizing deductions. Leveraging advanced algorithms and data analysis, taxpayers can unlock potential savings while simplifying the filing process. For those interested in the latest tools and design inspirations, check out our 3D mockup collection.

Table of Contents

The Role of AI in Taxation

Taxation has been a complicated landscape for many. With changing laws, numerous deductions, and credits available, keeping up can be daunting. AI, however, is making it easier than ever to navigate these complexities. By using algorithms and data analytics, AI can process vast amounts of data to provide insights that were previously difficult to obtain.

How AI Identifies Deductions

AI systems can analyze your financial data, documents, and transactions to identify potential tax deductions. Here’s how:

- Data Aggregation: AI can gather data from different sources including bank statements, receipts, and invoices.

- Pattern Recognition: Machine learning algorithms can recognize patterns in spending that could indicate deductible expenses.

- Real-time Updates: AI systems can update their databases with the latest tax laws, ensuring that users have the most current information.

Benefits of Using AI for Tax Deductions

The integration of AI into tax deduction processes comes with several notable benefits:

- Increased Accuracy: Reducing human error by relying on advanced algorithms to make calculations.

- Time Efficiency: Automating tedious tasks such as data entry and document organization.

- Personalized Recommendations: Tailored advice based on individual financial situations.

Potential Drawbacks

As with any technology, there are some drawbacks to consider:

- Data Privacy Concerns: Handling sensitive financial information raises security issues.

- Dependence on Technology: Relying heavily on AI may lead to a loss of personal understanding of tax matters.

AI Tools for Tax Deductions in 2025

Several AI-powered tools have emerged to assist taxpayers. Here are some noteworthy options:

| Tool Name | Description | Best For |

|---|---|---|

| TurboTax AI | Uses machine learning to provide personalized tax advice and deduction suggestions. | Individuals and freelancers |

| H&R Block Tax Pro Go | Combines AI and human expertise for a comprehensive filing experience. | Small businesses |

| Xero Tax | Offers AI tools for accountants to optimize tax submissions. | Accounting professionals |

Strategies for Maximizing Deductions with AI

Utilizing AI tools effectively can help you maximize your tax deductions:

1. Keep Detailed Records

Ensure that all your financial transactions are documented. Use apps that sync with your bank accounts to automatically track expenses.

2. Use AI-Powered Apps

Invest in apps that utilize AI to suggest potential deductions based on your spending habits.

3. Stay Informed

Regularly update yourself on tax laws and deductions that may apply. AI tools can help you with this by providing real-time updates.

Future of AI in Taxation

The future looks promising for AI in taxation. As technology evolves, so too will the capabilities of AI systems. Here are some trends to watch out for:

Enhanced Predictive Analytics

Future AI systems may offer predictive analytics, helping taxpayers forecast their tax liabilities based on current financial behavior.

Greater Integration of Blockchain Technology

Blockchain may work hand-in-hand with AI, offering secure and transparent methods for handling tax data.

Broader Accessibility

As these tools become more widespread and user-friendly, an increasing number of taxpayers will benefit from AI-powered insights.

Conclusion

AI is reshaping the landscape of taxation and tax deductions in 2025. By adopting these advanced technologies, taxpayers can navigate the complexities of tax laws more efficiently while maximizing their deductions. Though there are challenges to consider, the benefits far outweigh the potential drawbacks. It’s time to embrace AI and take control of your financial future.

FAQ

What are the benefits of using AI to discover tax deductions in 2025?

Using AI to discover tax deductions in 2025 allows individuals and businesses to maximize their tax savings by identifying eligible deductions that may have been overlooked, streamlining the tax preparation process, and ensuring compliance with the latest tax regulations.

How can I start using AI for tax deduction discovery?

To start using AI for tax deduction discovery, look for reputable tax software that incorporates AI technology, consult with tax professionals who utilize AI tools, or explore online platforms that offer AI-driven financial services.

Are there specific AI tools recommended for tax deductions in 2025?

Some recommended AI tools for tax deductions in 2025 include platforms like TurboTax, H&R Block, and specialized AI financial advisors that provide tailored recommendations based on your financial situation.

What types of tax deductions can AI help identify?

AI can help identify a wide range of tax deductions including home office expenses, medical expenses, charitable donations, education-related expenses, and business-related costs, among others.

Is it safe to use AI for tax-related advice?

Yes, using AI for tax-related advice is generally safe, especially when utilizing well-established software and platforms that comply with data privacy regulations and incorporate robust security measures.

Can AI help with tax planning in addition to finding deductions?

Yes, AI can assist with tax planning by analyzing your financial situation, forecasting future tax liabilities, and providing strategic recommendations to optimize your tax position throughout the year.