Unlocking Wealth: Benefits of AI-Driven Advisors

Discover the top benefits of AI-driven wealth advisors and how they can optimize your investment strategies for better financial outcomes.

In the rapidly evolving landscape of finance and technology, artificial intelligence (AI) is reshaping how we manage, invest, and grow our wealth. With the emergence of AI-driven wealth advisors, investors are now equipped with tools that enhance decision-making, optimize portfolios, and provide personalized financial strategies. This article delves into the myriad benefits of utilizing AI-driven wealth advisors, illustrating how they can empower investors to achieve their financial goals more efficiently.

As the financial landscape evolves, AI-driven advisors are transforming how individuals approach wealth management. These innovative tools offer personalized insights and data-driven strategies, making it easier for users to unlock their financial potential and achieve long-term goals. For those interested in branding their ventures, you can visualize your 3D logo concepts to enhance your professional presence.

Table of Contents

Understanding AI-Driven Wealth Advisors

AI-driven wealth advisors leverage advanced algorithms, machine learning models, and extensive data analytics to provide investment insights and recommendations tailored to individual client portfolios. Unlike traditional human advisors, these systems operate around the clock, analyzing vast amounts of market data to inform their strategies. Here are some key features of AI-driven wealth advisors:

- 24/7 Availability: AI advisors operate continuously, offering instant access to investment advice and portfolio management.

- Data-Driven Insights: They analyze historical data and market trends to provide evidence-based recommendations.

- Personalization: AI leverages user data to craft tailored investment strategies unique to each investor’s financial goals.

- Cost Efficiency: These solutions often come at a lower cost compared to traditional advisory services due to reduced overhead.

Enhanced Decision-Making

One of the foremost advantages of AI-driven wealth advisors is their ability to enhance decision-making. Traditional investing often involves human emotions, biases, and limited information processing capabilities. AI, on the other hand, offers a data-centric approach that mitigates these pitfalls. Here’s how:

Data Analysis and Insights

AI systems can process large datasets quickly and accurately, providing insights that would be impossible for a human trader. They can identify patterns, correlations, and anomalies in market data that inform investment strategies. For instance:

| Metric | Traditional Advisor | AI-Driven Advisor |

|---|---|---|

| Data Processing Speed | Hours to gather and analyze | Milliseconds |

| Pattern Recognition | Limited by human capabilities | Advanced algorithms recognize complex patterns |

| Bias Level | Subject to human emotions | Objective and data-driven |

Predictive Analytics

AI-driven advisors utilize predictive analytics to foresee potential market movements and investment opportunities. This capability helps investors make proactive decisions rather than reactive ones, increasing the potential for higher returns.

Cost Efficiency and Accessibility

Investing in wealth management services traditionally involves high fees and minimum investment requirements. AI-driven advisors have democratized access to financial services, making them more cost-effective and accessible to a broader audience.

Reduced Fees

AI technologies eliminate many of the overhead costs associated with human advisors. As a result, clients benefit from:

- Lower Management Fees: Many AI-driven platforms charge lower advisory fees, often around 0.25% to 0.50% of assets under management compared to the average 1% fee charged by human advisors.

- No Minimum Investment Requirements: Many platforms allow users to start investing with minimal initial capital, opening doors for new investors.

Increased Accessibility

The rise of robo-advisors and AI-driven platforms has allowed individuals from various backgrounds to engage in wealth management:

- Retail Investors: Even those with limited knowledge or experience can access sophisticated investment strategies.

- Small Business Owners: AI advisors can help manage business funds efficiently without needing large financial teams.

- Millennials and Gen Z: Younger investors are particularly drawn to the technology-driven approach, offering them a sense of control over their financial futures.

Personalization of Investment Strategies

Personalization is a hallmark feature of AI-driven wealth advisors. These platforms utilize algorithms that evolve based on user data and preferences, allowing them to offer customized investment solutions.

Understanding Client Goals

AI-driven systems gather information about an investor’s goals, risk tolerance, time horizon, and financial situation to construct a tailored investment strategy. For example:

- Risk Assessment: AI can analyze historical market performance relative to an investor’s risk appetite and adjust recommendations accordingly.

- Goal-Oriented Strategies: Whether the objective is retirement planning, saving for a home, or funding education, AI can align investment strategies with specific financial goals.

Continuous Learning

AI algorithms continuously learn from new data and market trends, ensuring that investment strategies remain relevant and effective. This adaptability is crucial in a fast-changing financial landscape.

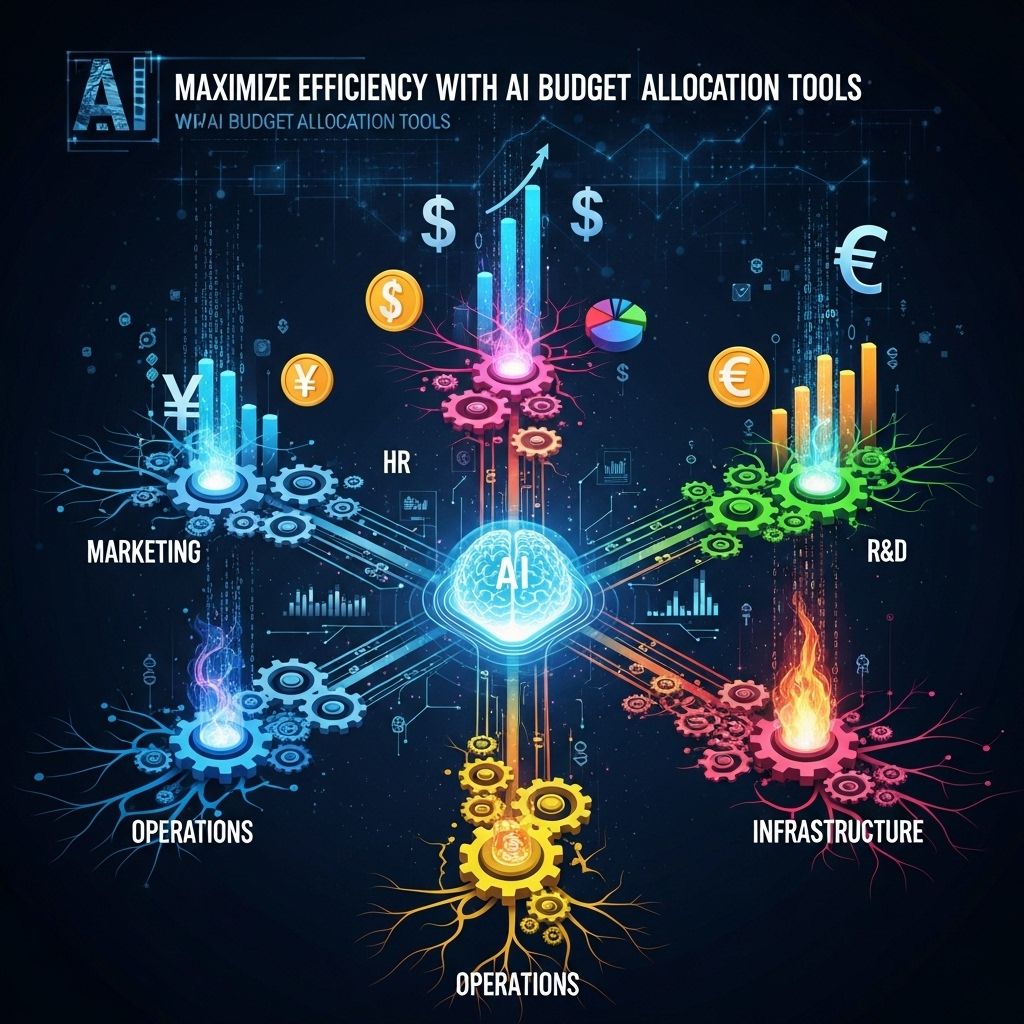

Risk Management and Diversification

Effective risk management is vital for any investment strategy. AI-driven advisors excel at identifying risks and suggesting diversification strategies to mitigate them.

Dynamic Portfolio Allocation

AI can assess risk levels in real-time and adjust portfolio allocations to optimize for risk and return. This dynamic approach contrasts with traditional strategies that may require periodic reviews.

Diversification Strategies

AI-driven wealth advisors can recommend optimal diversification across different asset classes and sectors to reduce risk. Benefits include:

- Minimized Volatility: Well-diversified portfolios are less susceptible to market swings.

- Enhanced Returns: AI can identify emerging sectors or assets that may outperform the broader market.

The Future of Wealth Management

As technology continues to advance, the role of AI in wealth management is expected to grow significantly. Industry experts predict that AI-driven solutions will become standard, creating a more efficient, informed, and equitable investing experience.

Integration with Human Advisors

While AI-driven wealth advisors offer numerous benefits, they are not a complete replacement for human advisors. The best outcomes often arise from a hybrid model where:

- Human Advisors focus on complex financial situations and emotional support.

- AI assists with data analysis, portfolio management, and routine tasks.

Conclusion

The integration of AI into wealth management heralds a new era of financial advisory services. The benefits of AI-driven wealth advisors—enhanced decision-making, cost efficiency, personalization, and risk management—make them an attractive option for investors at all levels. As this technology continues to evolve, it promises to make wealth management more accessible, efficient, and aligned with individual investor goals.

FAQ

What are the main benefits of using AI-driven wealth advisors?

AI-driven wealth advisors offer personalized investment strategies, enhanced data analysis, and 24/7 availability to better manage client portfolios.

How do AI-driven wealth advisors improve investment decisions?

They utilize advanced algorithms to analyze market trends, assess risks, and predict future performance, leading to more informed investment choices.

Are AI-driven wealth advisors more cost-effective than traditional advisors?

Yes, they often have lower fees due to reduced overhead costs, making wealth management more accessible for a broader range of investors.

Can AI-driven wealth advisors provide personalized financial planning?

Absolutely, they can tailor financial plans based on individual goals, risk tolerance, and financial situations using sophisticated data analytics.

Is the use of AI in wealth management safe?

Yes, reputable AI-driven wealth advisors implement robust security measures to protect client data and ensure safe transactions.

How can I get started with an AI-driven wealth advisor?

You can start by researching and selecting a reputable AI-driven wealth management platform, then creating an account and providing your financial details.