Revolutionize Your Finances: AI Bookkeeping for SMEs

Discover how AI bookkeeping assistants can transform financial management for SMEs, enhancing accuracy and efficiency.

In the fast-paced world of small and medium enterprises (SMEs), efficiency can mean the difference between success and failure. As businesses strive to maintain profitability while managing resources effectively, innovative solutions have emerged to streamline operations. Among these solutions, AI bookkeeping assistants stand out as transformative tools that not only simplify financial processes but also empower business owners to focus on growth and strategy.

In the evolving landscape of finance, AI bookkeeping is proving to be a game changer for small and medium enterprises (SMEs). By automating routine tasks and providing insightful analytics, AI-driven solutions enable businesses to streamline their financial processes and focus on growth. To see how creativity can enhance your brand’s presence, view 3D logo variations.

Table of Contents

Understanding AI Bookkeeping Assistants

AI bookkeeping assistants are software applications that leverage artificial intelligence and machine learning technologies to automate various accounting functions. These tools handle tasks efficiently, allowing professionals to allocate their time and skills to strategic initiatives instead of mundane data entry and bookkeeping chores.

What Can AI Bookkeeping Assistants Do?

- Automate Transactions: Automatically sync bank transactions and categorize expenses.

- Invoice Processing: Create, send, and follow up on invoices to ensure timely payments.

- Financial Reporting: Generate accurate, real-time financial reports for better decision-making.

- Tax Compliance: Assist in preparing and filing taxes, reducing the risk of errors.

- Data Analysis: Utilize analytics to provide insights into spending patterns and financial health.

The Benefits of AI in Bookkeeping

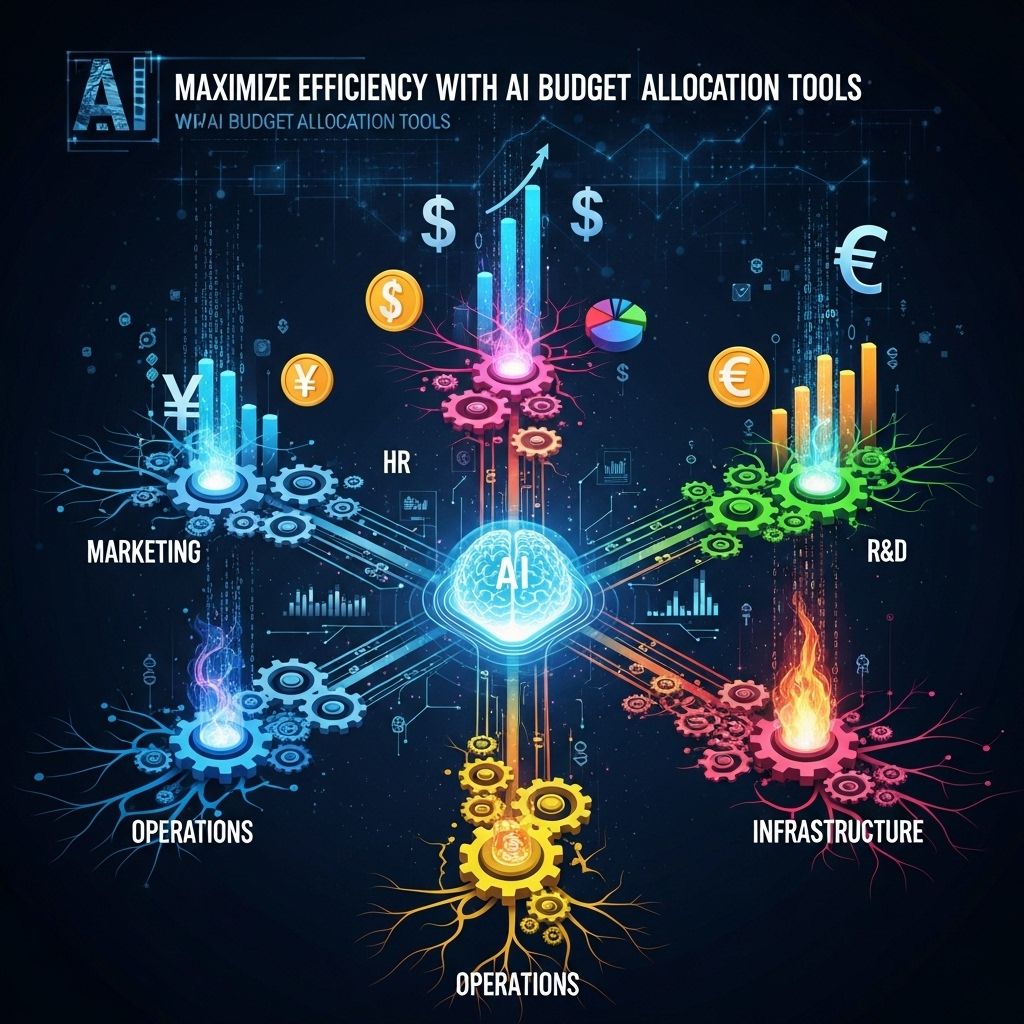

The integration of AI into bookkeeping offers several advantages that can significantly impact the operational efficiency of SMEs:

1. Time and Cost Efficiency

By automating routine tasks, businesses can save countless hours of manual labor that can be redirected to higher-value activities. This can lead to:

| Time Saved | Cost Reduction |

|---|---|

| Up to 50% on routine bookkeeping tasks | Reduction in hiring additional staff |

2. Increased Accuracy and Reduced Errors

Human error is a common challenge in bookkeeping. AI systems can significantly reduce these mistakes through precise calculations and consistent processes, ensuring that:

- Entries are accurate and timely.

- Financial discrepancies are flagged and resolved swiftly.

3. Enhanced Decision-Making

AI bookkeeping assistants provide real-time insights into financial data, allowing business owners to make informed decisions based on accurate and up-to-date information. Key performance indicators (KPIs) can be easily tracked, leading to:

- Better cash flow management.

- Informed investment decisions.

- Strategic planning and forecasting.

Choosing the Right AI Bookkeeping Assistant

With a variety of AI bookkeeping tools available, selecting the right one for your business requires careful consideration. Here are some factors to take into account:

1. Scalability

As your business grows, your bookkeeping needs will evolve. Ensure the software can scale alongside your operations, accommodating increased transactions and complexities.

2. User-Friendliness

A user-friendly interface is crucial for adoption among team members. Look for software that offers intuitive navigation and comprehensive support.

3. Integration Capabilities

Verify that the bookkeeping assistant integrates seamlessly with your existing tools, such as CRM systems, payment gateways, and e-commerce platforms. This integration will streamline processes further.

4. Security Features

Data security is paramount in financial management. Choose software that adheres to industry standards for data protection, including encryption and regular backups.

Popular AI Bookkeeping Tools

Several AI bookkeeping tools have gained popularity among SMEs for their innovative features and functionalities. Here are a few standout options:

- QuickBooks: A well-known accounting software that now incorporates AI for predictive analytics and automated bookkeeping tasks.

- Xero: Offers machine learning capabilities for categorizing transactions and forecasting financial trends.

- Zoho Books: Integrates AI to streamline invoicing and expense tracking, providing a comprehensive financial overview.

- FreshBooks: Especially favored by freelancers and small businesses, leveraging AI for easy invoicing and expense management.

Case Studies: SMEs Transforming Their Finances

To truly grasp the impact of AI bookkeeping assistants, consider the following case studies of SMEs that have successfully integrated these tools into their operations:

Case Study 1: Tech Startup

A tech startup implemented an AI bookkeeping assistant that automated routine tasks, allowing the owner to focus on product development. Within six months, they reported a:

- 30% reduction in overhead costs.

- 40% increase in productivity.

Case Study 2: E-commerce Business

An e-commerce business utilized AI for real-time inventory tracking and financial reporting, leading to:

- Improved cash flow management.

- 20% growth in sales due to better decision-making.

Future Trends in AI Bookkeeping

As AI technology continues to evolve, the future of bookkeeping will likely see even more innovations:

1. Advanced Predictive Analytics

AI systems will increasingly use predictive analytics to offer forecasts on cash flow, helping businesses to plan better while managing risks.

2. Enhanced Natural Language Processing (NLP)

With advancements in NLP, AI bookkeeping tools will communicate more effectively with users, allowing for voice commands and more intuitive interactions.

3. Increased Regulatory Compliance

AI will adapt to changes in regulations more swiftly, ensuring that businesses remain compliant without the need for extensive manual oversight.

Conclusion

AI bookkeeping assistants are undeniably a game changer for SMEs. By automating tedious tasks and providing data-driven insights, these tools empower business owners to focus on what truly matters: growing their businesses. As technology progresses, the potential for AI in the financial sector will only expand, promising even greater efficiencies and capabilities for SMEs in the years to come.

FAQ

What are AI bookkeeping assistants?

AI bookkeeping assistants are software solutions that utilize artificial intelligence to automate and streamline bookkeeping tasks, such as invoicing, expense tracking, and financial reporting for small and medium-sized enterprises (SMEs).

How can AI bookkeeping assistants benefit SMEs?

AI bookkeeping assistants can save SMEs time and reduce errors by automating routine tasks, providing real-time insights into financial data, and allowing business owners to focus more on strategic decision-making.

Are AI bookkeeping assistants easy to use for non-technical users?

Yes, most AI bookkeeping assistants are designed with user-friendly interfaces, making them accessible for non-technical users while still offering powerful features for advanced users.

What features should SMEs look for in an AI bookkeeping assistant?

SMEs should look for features such as automated data entry, expense categorization, real-time financial reporting, integration with other business tools, and strong security measures.

How do AI bookkeeping assistants ensure data security?

AI bookkeeping assistants typically employ encryption, secure access controls, and regular security updates to protect sensitive financial data from unauthorized access and breaches.

Can AI bookkeeping assistants integrate with existing accounting software?

Yes, many AI bookkeeping assistants are designed to integrate seamlessly with popular accounting software, enhancing functionality and ensuring a smooth transition for SMEs.