Best AI Tools for SME Finance in 2025

Discover the top AI tools that will transform SME finance in 2025, enhancing efficiency and decision-making for small and medium enterprises.

The world of finance is rapidly evolving, and small to medium-sized enterprises (SMEs) are no exception. As we approach 2025, the integration of artificial intelligence (AI) into finance systems is set to revolutionize how SMEs manage their financial operations. From automating routine tasks to providing deep insights into data, AI tools are becoming essential for SMEs looking to stay competitive in a technology-driven landscape. This article will explore some of the most impactful AI tools that SMEs should consider adopting in the coming years.

As we look ahead to 2025, small and medium-sized enterprises (SMEs) are increasingly leveraging AI tools to streamline their financial operations. These innovative technologies are set to enhance efficiency, improve decision-making, and provide deeper insights into financial health. For those interested in branding enhancements, you can download stunning 3D logo designs.

Table of Contents

Understanding the Benefits of AI in SME Finance

AI technology offers several advantages that can significantly enhance the financial management of SMEs. Here are some key benefits:

- Efficiency: Automating repetitive tasks like data entry saves time and reduces errors.

- Data Analysis: AI can process vast amounts of data quickly, providing actionable insights for decision-making.

- Cost Reduction: AI tools can help reduce operational costs by optimizing resource allocation.

- Predictive Analytics: These tools can forecast trends, helping SMEs to make informed financial predictions.

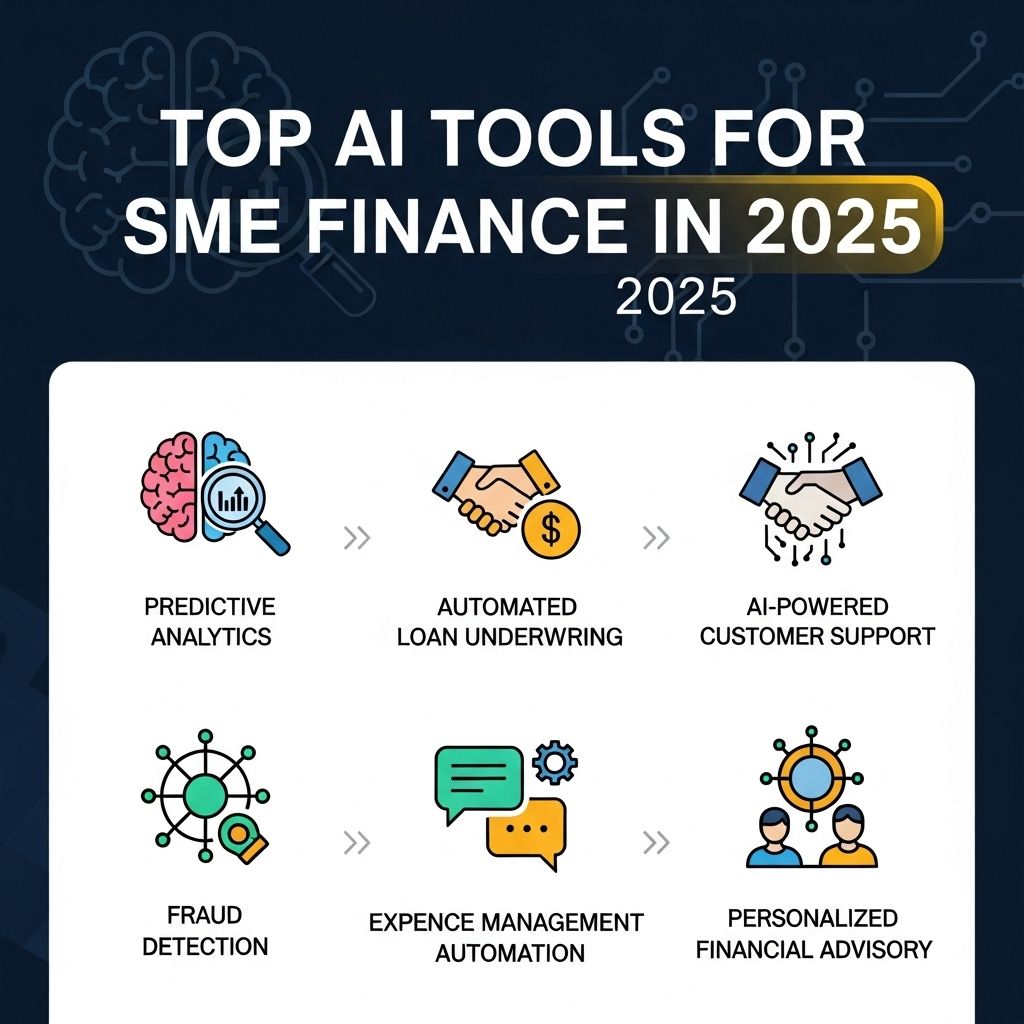

Key AI Tools to Watch in 2025

As we look towards the future, several AI tools are emerging as leaders in the finance space for SMEs. Here’s a breakdown of some of the top tools that are likely to shape financial management in 2025:

1. QuickBooks Online with AI Features

QuickBooks is a well-known name in accounting software, and its integration of AI features is set to transform financial management for SMEs. Key features include:

- Automated Bookkeeping: AI algorithms can automatically categorize transactions.

- Financial Forecasting: Real-time insights and trends help businesses plan better.

2. Xero’s Machine Learning Capabilities

Xero is enhancing its platform with machine learning capabilities that assist in:

- Invoice Management: Smart invoice processing and payment reminders.

- Expense Tracking: Automated expense categorization through scanning receipts.

3. Zeta’s AI-Driven Expense Management

Zeta offers an innovative expense management solution that leverages AI to streamline financial processes:

- Real-Time Insights: Provides actionable insights into spending patterns.

- Policy Enforcement: Ensures compliance with company spending policies.

Evaluating AI Tools for Your SME

When considering AI tools for your SME, it’s essential to evaluate them based on certain criteria. Here’s a checklist to guide you:

| Criteria | Importance | Considerations |

|---|---|---|

| User-Friendliness | High | Can your team easily navigate the tool? |

| Integration Capabilities | High | Does it integrate well with your existing systems? |

| Cost | Medium | Is it within your budget while providing necessary features? |

| Scalability | Medium | Can it grow with your business? |

Future Trends in AI for SME Finance

As AI technology continues to develop, several trends are anticipated to shape the financial landscape for SMEs:

1. Enhanced Personalization

AI tools will increasingly provide personalized financial advice, tailored to the specific needs and goals of each business. This means more relevant and effective financial strategies.

2. Advanced Security Measures

With the rise of cyber threats, AI will play a crucial role in enhancing security protocols, protecting sensitive financial data.

3. Integration with Blockchain

The combination of AI and blockchain technology will enable greater transparency and efficiency in financial transactions.

Conclusion

The future of finance for SMEs is undeniably intertwined with AI. As these tools become more sophisticated and accessible, small to medium-sized enterprises will have the opportunity to leverage technology to optimize their financial operations, enhance decision-making, and ultimately drive growth. By embracing these AI tools in 2025 and beyond, SMEs can position themselves as competitive players in an ever-evolving market.

FAQ

What are the best AI tools for SME finance in 2025?

In 2025, some of the top AI tools for SME finance include machine learning platforms for predictive analytics, automated bookkeeping software, and AI-powered expense management systems that streamline financial operations.

How can AI tools improve financial management for SMEs?

AI tools can enhance financial management for SMEs by automating repetitive tasks, providing real-time data analysis, predicting cash flow trends, and optimizing budgeting processes.

What features should SMEs look for in AI finance tools?

SMEs should look for features such as user-friendly interfaces, integration capabilities with existing systems, robust data security, and advanced analytics functionalities in AI finance tools.

Are AI finance tools cost-effective for small and medium enterprises?

Yes, many AI finance tools are designed to be cost-effective for SMEs, offering scalable solutions that can fit various budgets and help reduce operational costs in the long run.

How can SMEs ensure data security when using AI finance tools?

SMEs can ensure data security by choosing AI finance tools with strong encryption methods, regular security updates, and compliance with data protection regulations.

What role will AI play in the future of SME finance?

AI will play a crucial role in the future of SME finance by enabling smarter decision-making, enhancing financial forecasting accuracy, and automating compliance processes, thereby driving growth and efficiency.