Boost Efficiency with AI Invoice Tools for Teams

Discover how AI invoice tools can enhance team efficiency and streamline your invoicing process for better productivity.

In today’s fast-paced business environment, where every second counts, the integration of Artificial Intelligence (AI) into operational processes is no longer a luxury but a necessity. Among various applications of AI, invoice processing has emerged as a critical area where companies can significantly boost efficiency, accuracy, and cost-effectiveness. With the help of AI invoice tools, organizations can streamline their financial workflows, reduce manual errors, and enhance team collaboration.

In today’s fast-paced work environment, utilizing AI invoice tools can significantly enhance team efficiency by automating routine tasks and reducing manual errors. By streamlining the invoicing process, teams can focus more on strategic initiatives rather than administrative work. For those looking to elevate their brand, consider exploring resources like download stunning 3D logo designs.

Table of Contents

The Evolution of Invoice Processing

Traditionally, invoice processing has been a labor-intensive task that involved manual data entry, verification, and approval. This process is not only time-consuming but also prone to human errors. However, with the advent of AI technologies, businesses now have access to automated solutions that can handle these tasks much more efficiently.

Key Stages of Traditional Invoice Processing

- Data Entry: Manually entering invoice details into financial systems.

- Verification: Checking the accuracy of data against purchase orders.

- Approval: Routing invoices through various levels of management for approval.

- Payment: Processing payment to vendors once invoices are approved.

Advantages of AI Invoice Tools

Integrating AI invoice tools into your business processes can lead to numerous advantages, including:

1. Enhanced Accuracy

AI-driven systems utilize Optical Character Recognition (OCR) and machine learning algorithms to minimize errors in data entry. By automatically extracting relevant information from invoices, these tools ensure that financial data is accurate, significantly reducing discrepancies.

2. Time Savings

Automating the invoice process can lead to substantial time savings. Tasks that previously took hours or even days can now be completed within minutes, freeing up team members to focus on more strategic initiatives.

3. Cost Reduction

By minimizing manual labor and expediting the approval process, businesses can reduce operational costs. AI tools also help avoid late payment penalties and improve cash flow management.

4. Improved Compliance

AI tools often come equipped with built-in compliance checks. This feature ensures that invoices are processed according to regulatory standards, reducing the risk of non-compliance and potential fines.

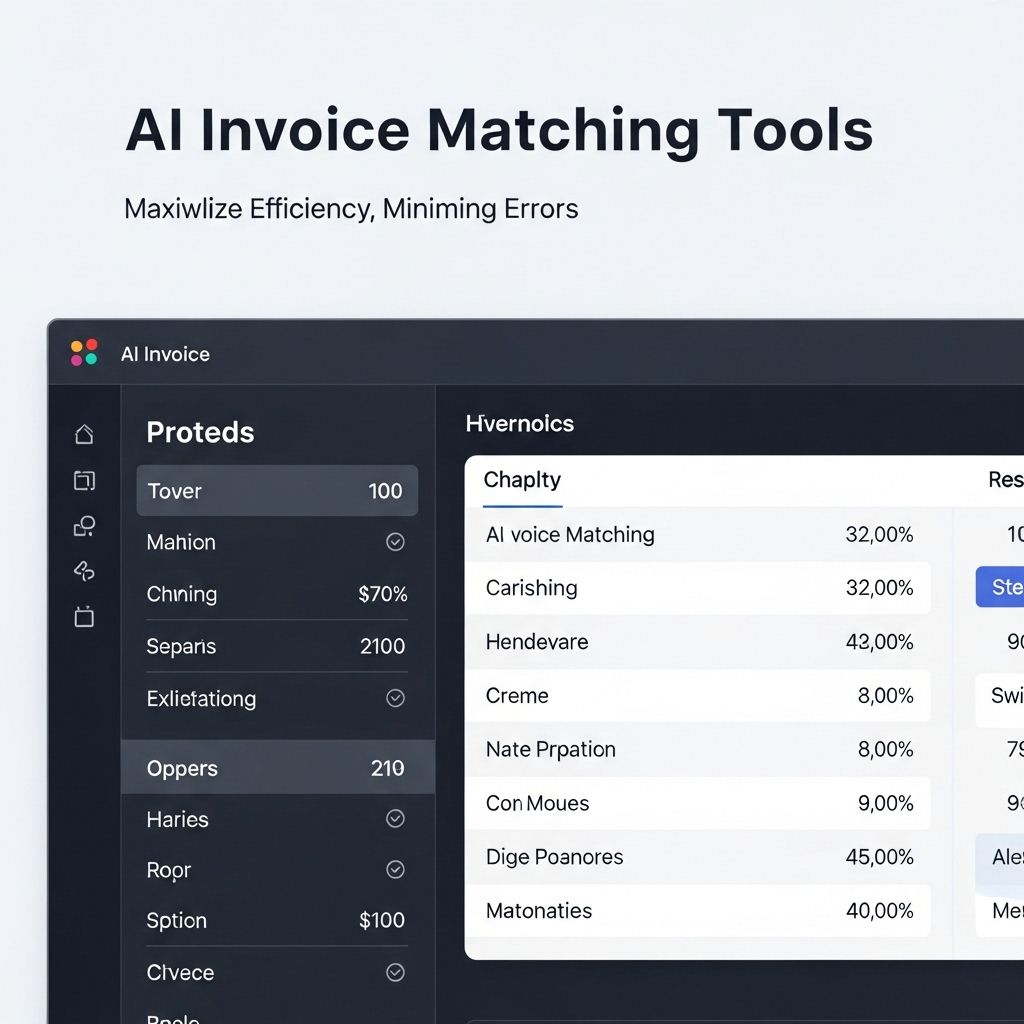

Popular AI Invoice Tools in the Market

Numerous AI invoice tools are available, catering to various business needs and sizes. Here are some of the most popular options:

| Tool Name | Key Features | Best For |

|---|---|---|

| Melio | Automated vendor payments, invoice tracking, and reporting. | Small businesses |

| Tipalti | Global payment automation, compliance, and reconciliation. | Midsize to large enterprises |

| FreshBooks | Invoicing, expense tracking, and reporting. | Freelancers and startups |

| Xero | Cloud-based accounting, invoicing, and payroll. | Small to medium-sized businesses |

How to Implement AI Invoice Tools

Implementing AI invoice tools involves several steps to ensure successful integration into your existing financial workflows:

Step 1: Assess Your Needs

Identify your current invoice processing challenges and determine what features are essential for your organization.

Step 2: Evaluate Available Tools

Research various tools that fit your requirements. Consider factors such as pricing, scalability, ease of use, and integration capabilities.

Step 3: Train Your Team

Provide training for your team on how to use the new tool effectively. This step is critical for maximizing the tool’s potential and ensuring a smooth transition.

Step 4: Monitor and Optimize

After implementation, continuously monitor the tool’s performance and gather feedback from users. Use this information to make necessary adjustments and improve processes.

Challenges in Adopting AI Invoice Tools

While AI invoice tools offer numerous benefits, organizations may face challenges during the adoption process:

Integration Issues

Integrating new AI tools with existing financial systems can sometimes be complex and require technical expertise.

Cost Considerations

While AI tools can save money in the long run, the initial investment can be substantial, especially for smaller businesses.

Change Management

Employees may resist transitioning to automated processes, particularly if they are accustomed to traditional methods. Change management strategies are essential to address these concerns.

Future Trends in AI Invoice Processing

The future of AI invoice processing is promising, with several trends expected to shape the landscape:

1. Advanced Machine Learning Algorithms

As machine learning continues to evolve, AI tools will become even more proficient at learning from past data, leading to improved accuracy and efficiency.

2. Enhanced Analytics

AI-driven analytics will provide deeper insights into spending patterns, helping organizations make informed financial decisions.

3. Greater Customization

Future AI tools will likely offer more customization options, allowing businesses to tailor functionalities to their unique needs.

4. Integration with Other AI Solutions

In the future, AI invoice tools may integrate more seamlessly with other AI applications, such as chatbots and predictive analytics, creating a comprehensive financial management ecosystem.

Conclusion

As businesses strive for operational excellence, the implementation of AI invoice tools presents an opportunity to enhance efficiency, accuracy, and compliance in financial processes. While challenges may arise during the adoption phase, the long-term benefits far outweigh the temporary hurdles. By embracing the future of invoice processing, organizations can position themselves for success in an increasingly competitive landscape.

FAQ

What are AI invoice tools?

AI invoice tools are software applications that leverage artificial intelligence to automate the process of invoice management, including data entry, invoice generation, and payment tracking.

How do AI invoice tools improve team efficiency?

AI invoice tools streamline the invoicing process by reducing manual data entry, minimizing errors, and speeding up payment cycles, allowing teams to focus on more strategic tasks.

Can AI invoice tools integrate with existing accounting software?

Yes, many AI invoice tools can seamlessly integrate with popular accounting software, enhancing overall financial management and ensuring data consistency.

What features should I look for in an AI invoice tool?

Look for features such as automated data extraction, customizable invoice templates, payment reminders, and analytics to track invoicing performance.

Are AI invoice tools suitable for small businesses?

Absolutely! AI invoice tools can benefit small businesses by automating tedious tasks, improving cash flow management, and reducing operational costs.